Ultimate Guide for Successful Retail Turnaround

More retailers globally and in Nigeria more specifically have been in distress since the global COVID-19 pandemic, and many are in distress today also no thanks to the EndSAS crisis! Unfortunately, some are in denial about their situation; others are busy fixing the wrong problems.

How do you spot a distressed retailer?

What’s a good reality check for retailers? How can a retailer tell whether it’s in a distressed situation? We recommend both an analytical and a strategic approach.

Strategically, retail leaders should keep a close watch on their performance in the six dimensions of retail excellence: customer focus, merchandising, operations, infrastructure, people, and, most important, customer proposition. Material underperformance in any of these dimensions can be deeply problematic, but if a retailer doesn’t have a compelling customer proposition—a reason for customers to choose that retailer over competitors—it simply won’t survive.

Ultimate Guide for Successful Retail Turnaround

Retailers should monitor their performance in the six dimensions of retail excellence.

How do you turn the company around?

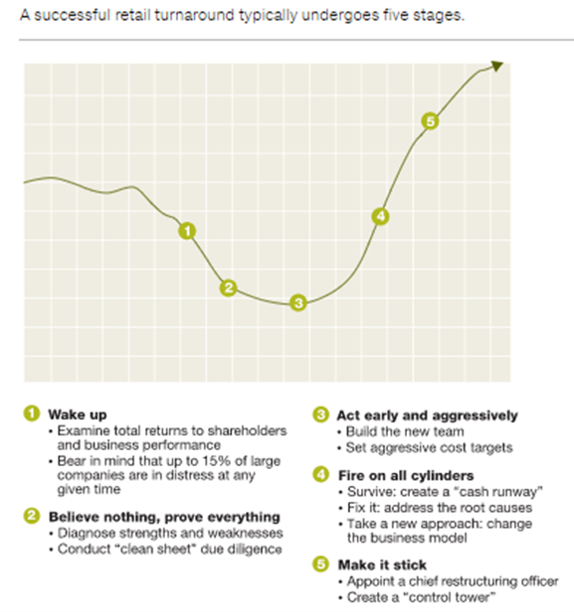

The experiences of distressed retailers that have successfully turned their business around, either during or since the global financial crisis, have shown that a five-stage approach to retail turnarounds can lead to sustained success.

A successful retail turnaround typically undergoes 5 stages.

Stage 1: Wake up

The first stage of the turnaround sounds easy and obvious: acknowledge that your company is in distress. But for executives accustomed to success, this stage can be difficult and humbling. Denial is the norm. Most retailers either underestimated the severity of the problem or refused to accept that there was a problem at all.

Take a hard look at your company’s TRS performance; test whether your customer proposition is resonating with consumers. If your company is indeed in distress, it’s best to come to terms with it now, while there’s still time to act.

Stage 2: Believe nothing, prove everything

Retail leaders must then seek to understand the causes of distress—and do so in a fact-based way. Company myths can be pervasive and difficult to dispel; many companies move reflexively to action based on long-held beliefs and assumptions, not taking the time to figure out if they’re attacking the right problem. Many indeed conducts a diagnostic at the start of their turnaround program, However, many often jumped to what we thought the solution was, only to find out later that they had wasted our time and effort.

A rigorous diagnostic increases the program’s chances of success: about 60 percent of companies that undertook a diagnostic achieved a successful turnaround. The success rate was only 34 percent among companies that didn’t do a diagnostic.

The diagnostic should bring to light what’s not working, but it should also highlight what’s working well. Often, companies become too absorbed pinpointing the problems and overlook inherent strengths in their businesses that can help them overcome their difficulties. Turnaround cases in which the company diagnoses both its strengths and weaknesses is more than twice as likely to succeed as a turnaround in which the diagnostic identifies only the company’s weaknesses.

We recommend that retailers take a “clean sheet” approach, which can be laborious but often yields powerful and surprising insights.

For example, One retailer, in undertaking a clean-sheet exercise, discovered that no one on the top team knew the total number of the company’s back-office locations or the size of its workforce across all subsidiaries. Because of disparate data systems, gathering this information was a surprisingly tedious task. But doing the legwork paid off: after the clean-sheeting exercise, the company found that five of its back offices and several support functions had considerable opportunities to improve efficiency. Within six months, the retailer was able to generate material cash savings through lease exits and consolidation of back-office teams.

Stage 3: Act early and aggressively

Once the causes of distress are clear, a retailer must move quickly and boldly. In particular, the CEO must put in place an action-oriented executive team and set ambitious cost targets. Both will be critical to survival.

Without major changes in the top team, it’s hard for a company to make a radical departure from past decisions and direction. One CEO who has led multiple turnarounds has even gone so far as to formulate the following guideline: “My rule of thumb for the top team is that a third will remain, a third will be promoted from within the company, and a third will come from outside. Otherwise, nothing changes.”

Once in place, the top team must then rapidly find ways to cut costs. For retailers, the biggest cost levers are typically head-office costs, supplier funding and cost of goods sold (COGS), and property and store costs.

Head-office costs. Head-office costs can be a drag on retailers’ profit-and-loss statements. A retail CEO should streamline headquarters if one or more of the following is true:

- The company has too many committees and boards that have been built up over the years (as a result of past priority projects or acquisitions) and never culled. One incoming turnaround CEO described encountering “a board for every topic.” Company leaders should be taking action, not sitting in meetings.

- The headquarters organization is top-heavy. Simply splitting the head office into salary tiers can highlight this issue: there shouldn’t be more executives at the highest level than in the next couple of levels.

- Executives have too small a span of control. The right span varies for every role, but in general (except perhaps for specialist roles), if each manager supervises fewer than seven or eight team members, the organization would benefit from delayering.

Supplier funding. Supplier negotiations, with the aim of lowering COGS, are a critical lever for most retailers. In distress situations, we have found that assertive and creative approaches to suppliers can create value very quickly.

One retailer was experiencing dramatic sales declines due to “showrooming”: customers would browse in the stores but use their mobile devices to buy from online stores—often while they were still in the store, taking advantage of the ‘product touch appeal’ and free Wi-Fi. The company’s analysis of industry-sales data strongly suggested that its in-store displays and promotions correlated with online sales: when a product was displayed prominently in its stores, overall online sales (including Amazon’s sales) of that product rose; when stores stopped promoting the product, online sales went down. The retailer negotiated with its suppliers to get a “fair share” of the value by calculating the online-sales boost from in-store displays. Over the following six months, the retailer renegotiated with all of its suppliers and agreed on a level of ongoing funding support that offset the retailer’s promotional costs.

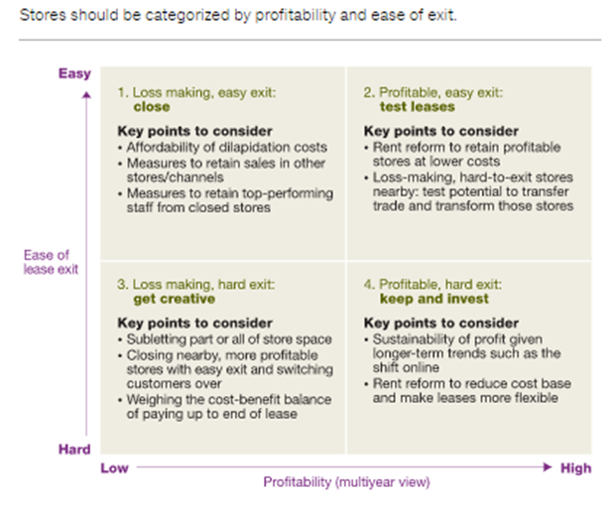

Property costs. As sales migrate online, a legacy store network can act as the proverbial noose around a retailer’s neck. To get a realistic picture of its store network’s future value, a retailer should adjust for industry trends (such as the shift to online) when calculating store profitability.

A leisure retailer, for example, launched a store-transformation program that initially encompassed only the 5 percent of its stores that were unprofitable. But when the company extrapolated current trends into the future—specifically, the migration of sales from physical stores to online—it projected a 30 percent decline in sales volume across all stores within three years. And after taking into account the allocation of central costs (such as the IT to support store systems), the retailer realized that more than half of its stores could become unprofitable in three years.

The company thus radically redefined the scope of its store-transformation program. It evaluated the entire network from a “zero base”—meaning each store needed to justify its existence. The company divided its stores into four groups based on profitability and ease of lease exit, then developed a different strategy for each group (Exhibit 3).

Stores should be categorized by profitability and ease of exit.

Stage 4: Fire on all cylinders

Too often, retail executives in turnaround situations think only about cost cutting. While cost cutting is necessary when the company is in survival mode, it won’t always address the root causes that led to a turnaround situation in the first place.

For instance, turnaround actions focused on costs often do not address challenges related to business model. Without thoughtful business-model actions—format renewal or reinvention, shifts in the trading strategy (in assortment, pricing, or communications, for example), or even a major change to the business model—the company faces a heightened risk of returning to a distressed situation.

One accessories manufacturer traditionally sold most of its products to distributors, which would then sell to multibrand retailers. The company also owned and operated a handful of concept stores as brand flagships. It had steered clear of e-commerce to avoid competing with its distributors and retail partners. However, an analysis of channel profitability and customer trends showed that the future sources of profitable growth were the online channel and owned concept stores. The company thus turned its channel strategy on its head. Execution of the new strategy was a critical element of a turnaround that has led to a fourfold rise in share price and TRS uplift of 190 percent in less than two years.

Stage 5: Make it stick

A successful retail turnaround often involves changes across hundreds of stores, brought to fruition by many thousands of frontline staff, which translates into a significant performance-management challenge. According to research, the average C-level executive spends approximately 15 hours per month in performance reviews, compared with approximately 40 hours per month for a turnaround one.

One approach that works well in turnarounds is to establish a “chief restructuring officer” (CRO) role for a limited period, typically 9 to 18 months. The CRO, usually an external hire with extensive experience in distressed turnarounds, leads the turnaround office—a “control tower” for all turnaround initiatives—and is responsible for spurring a radical rethink of the company’s operating model, pushing managers to reexamine how things are done, and challenging their assumptions about what is possible. The most effective CROs engage all stakeholders early and continuously, and they motivate colleagues by telling the positive change story over and over again. As a change leader, the CRO should operate as an extension of the CEO, with the authority and credibility in the organization to make decisions (with the approval of the CEO). The CRO doesn’t replace line leaders, but rather supports the CEO in driving the transformation so that the day-to-day tasks of running the business are not neglected.

This level of central control may seem like overkill, but our experience shows that without it, different parts of the business can easily report delivery of “turnaround benefits” while the profit-and-loss statement stubbornly stays the same. Research shows that turnarounds with strong governance are seven times more likely to succeed than those without it.

Conclusion

Times are indeed tough for retailers. But being in a distressed situation isn’t cause for despair. If retail leaders face the facts early, identify and address the root causes of their financial distress, take costs out quickly, and ensure disciplined execution, they can deliver—and rapidly move beyond—a turnaround.

Remember, most retail businesses are in some aspect of Stage 1 at any given time.

But…more than one Stage 2 or Stage 3— 0r Stage 5? Let’s talk!